How To Checkout With Your HSA / FSAs

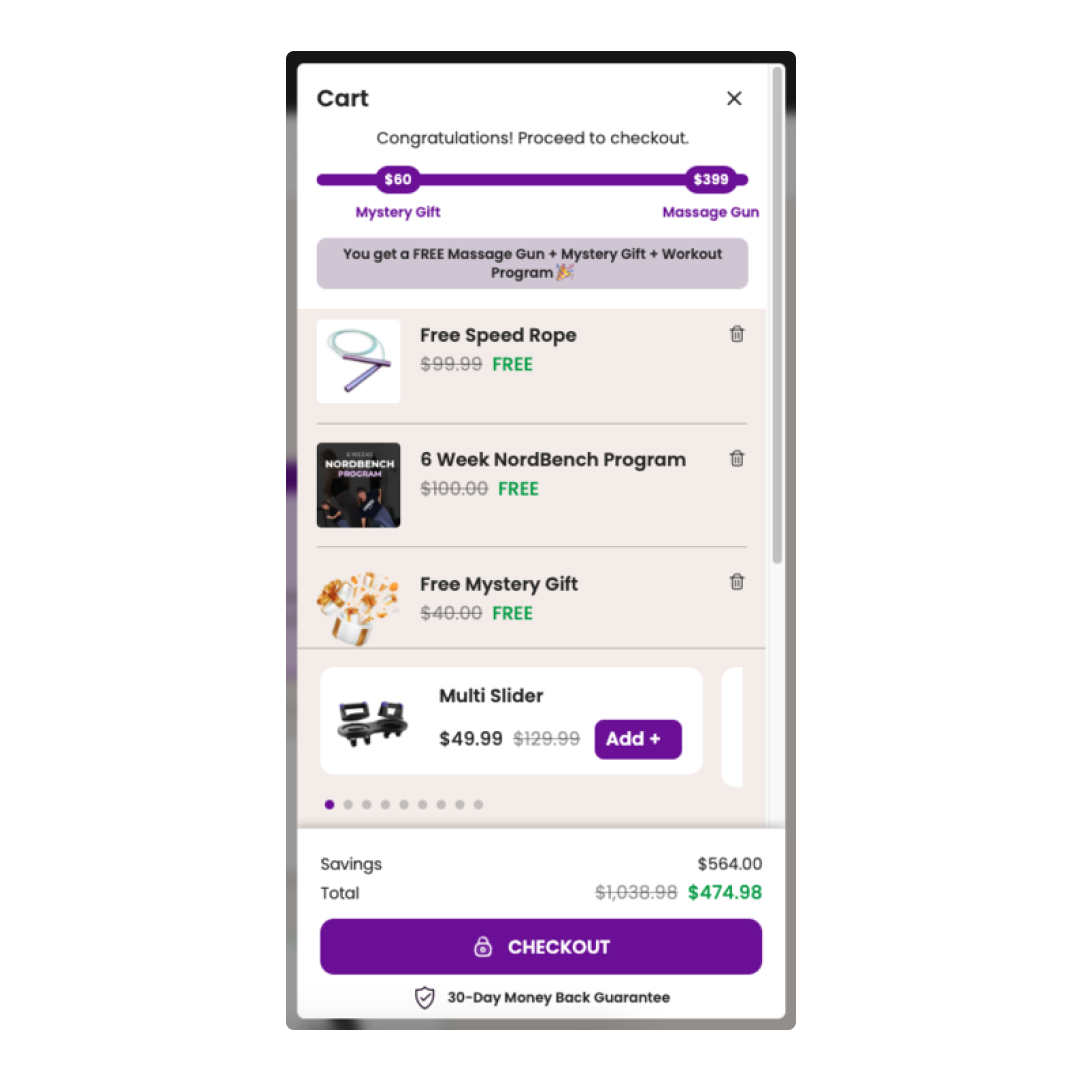

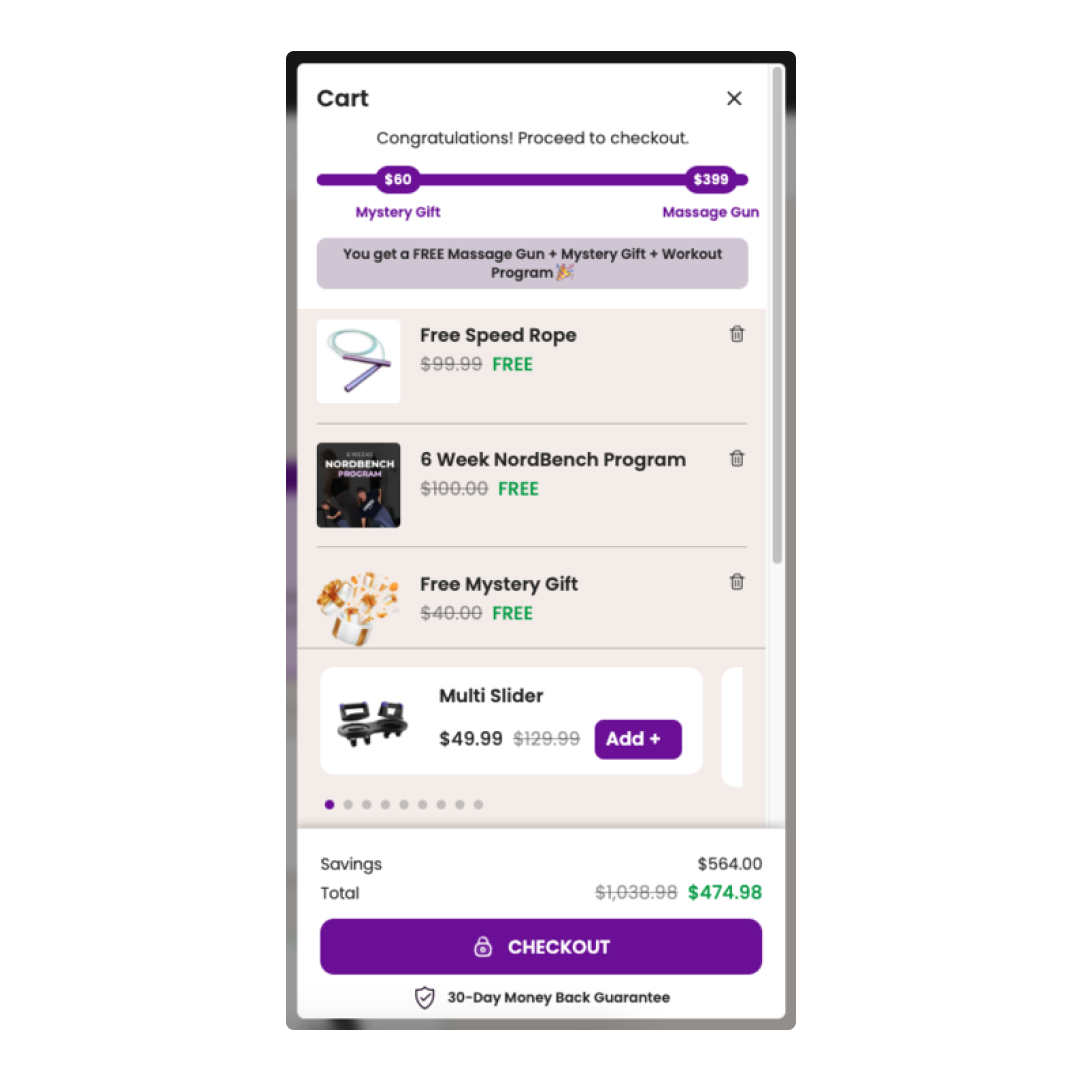

Browse through our catalogue and add your chosen products to cart. Once you're done, proceed to checkout.

Ensure you are not signed into “Shop Pay” or any express checkout methods. If you're prompted for an OTP, close the pop-up. If you're already signed into "Shop Pay", checkout as guest at the bottom of the page.

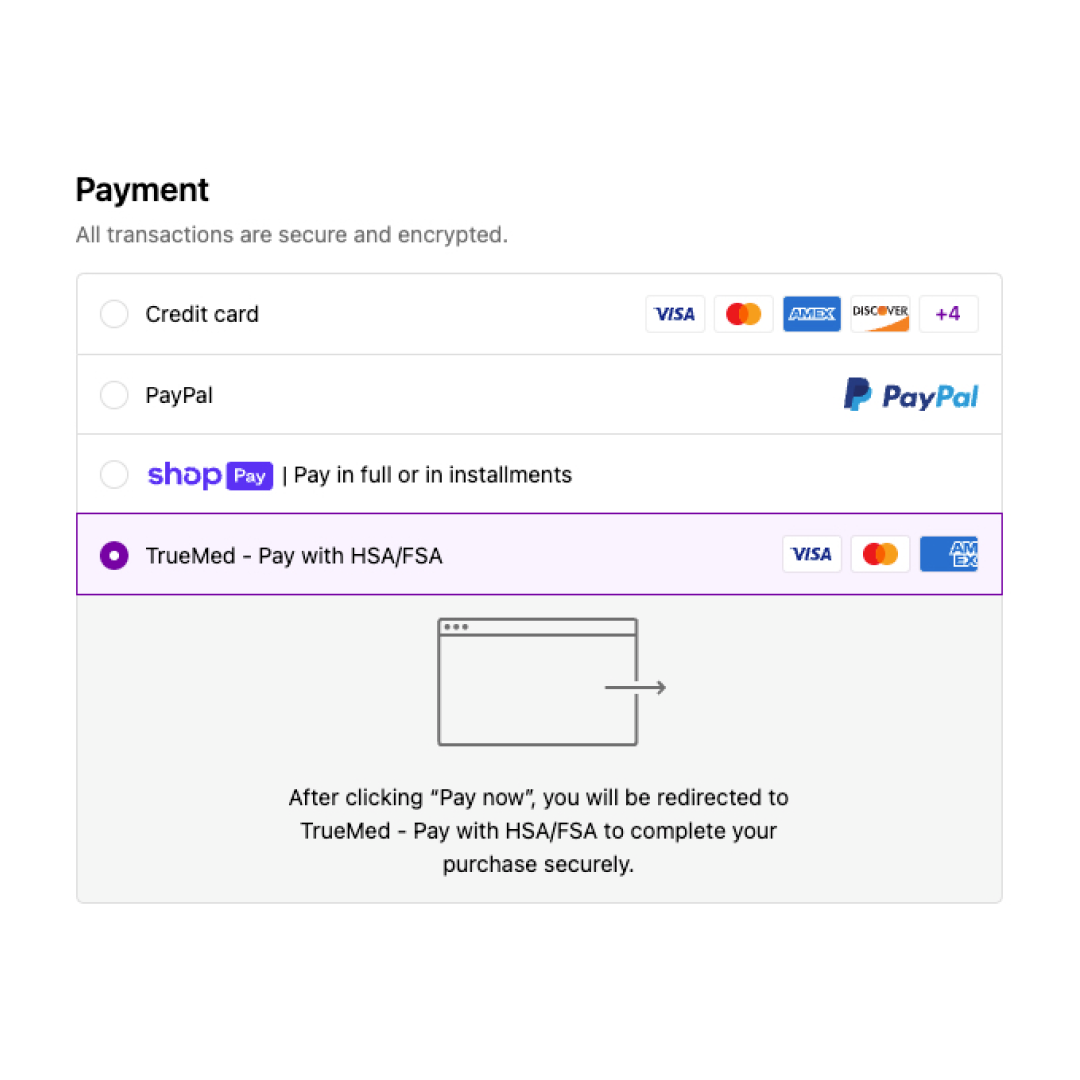

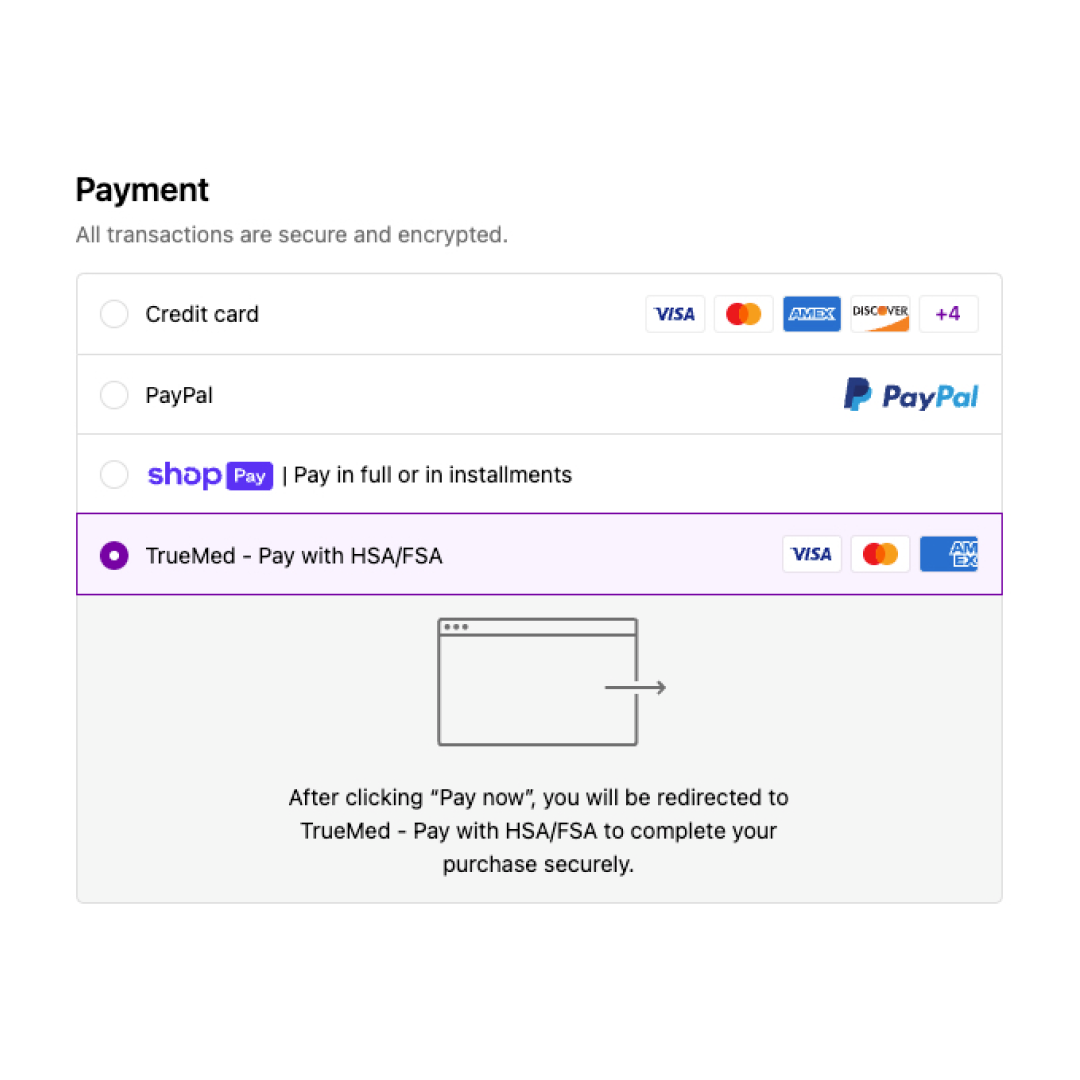

Finish filling up the rest of the fields and proceed to payment methods. Once there, select Truemed. Upon clicking "Complete Order", you will be redirected to the Truemed page.

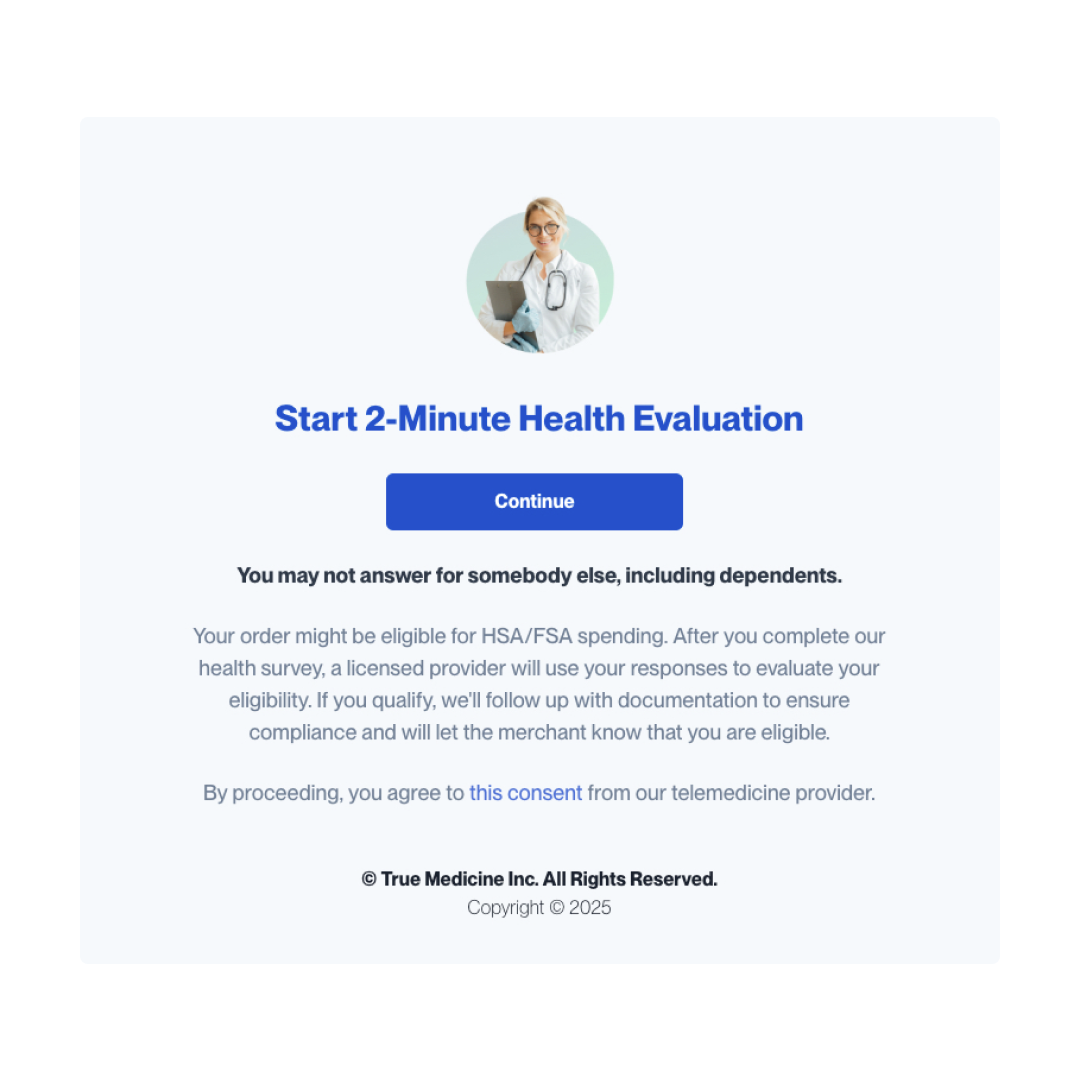

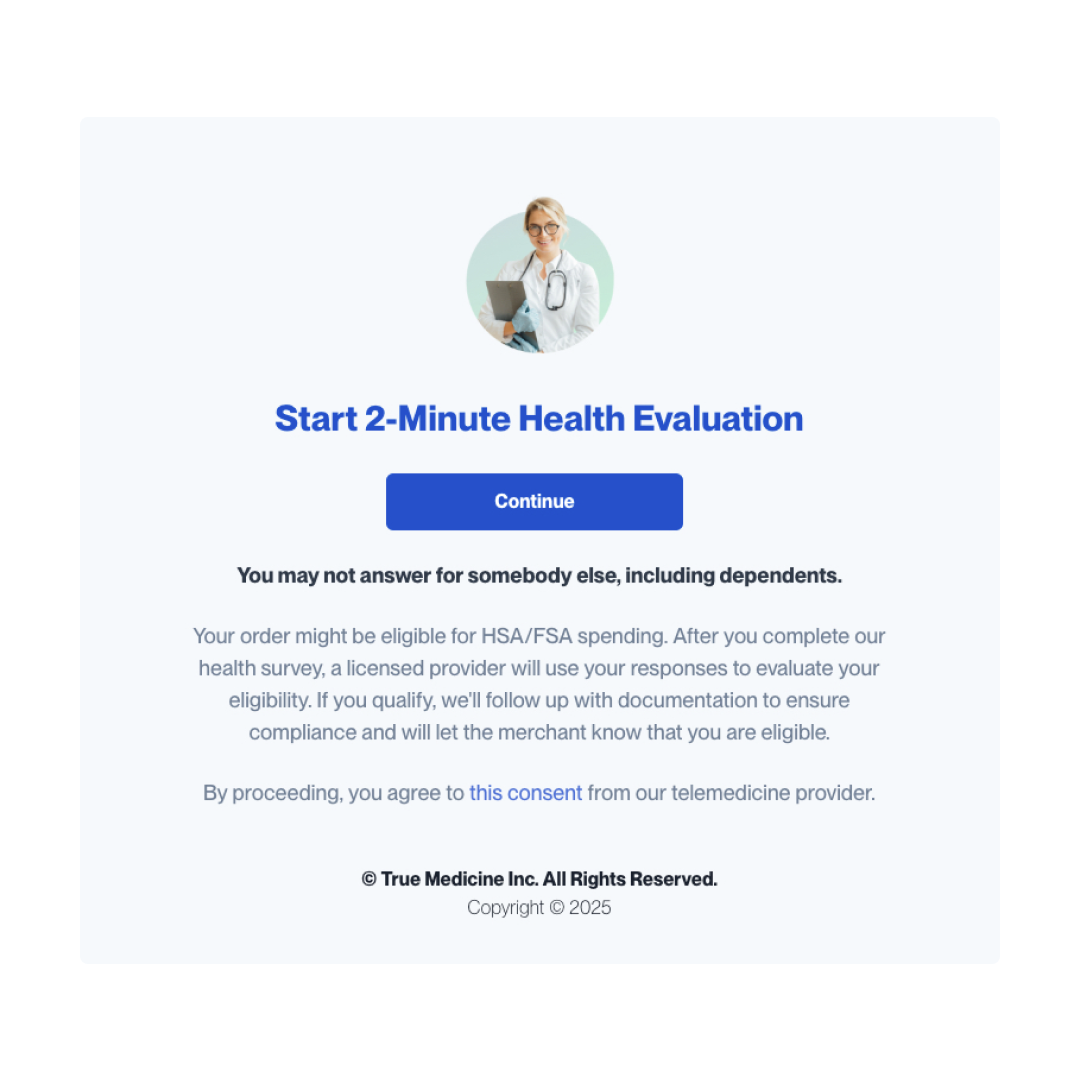

Answer a brief, guided health survey to confirm eligibility for HSA/FSA spending. A licensed professional will evaluate you based on your responses.

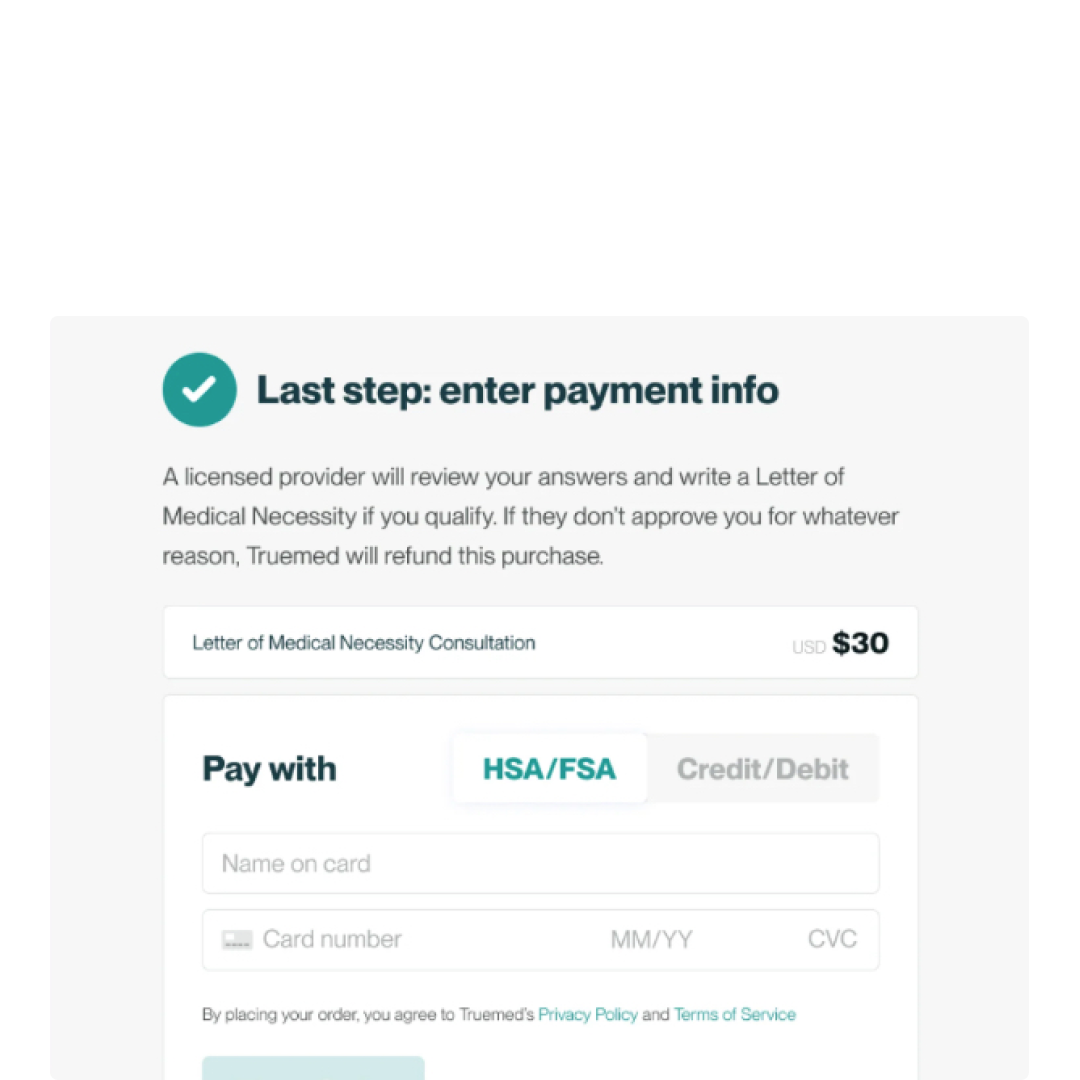

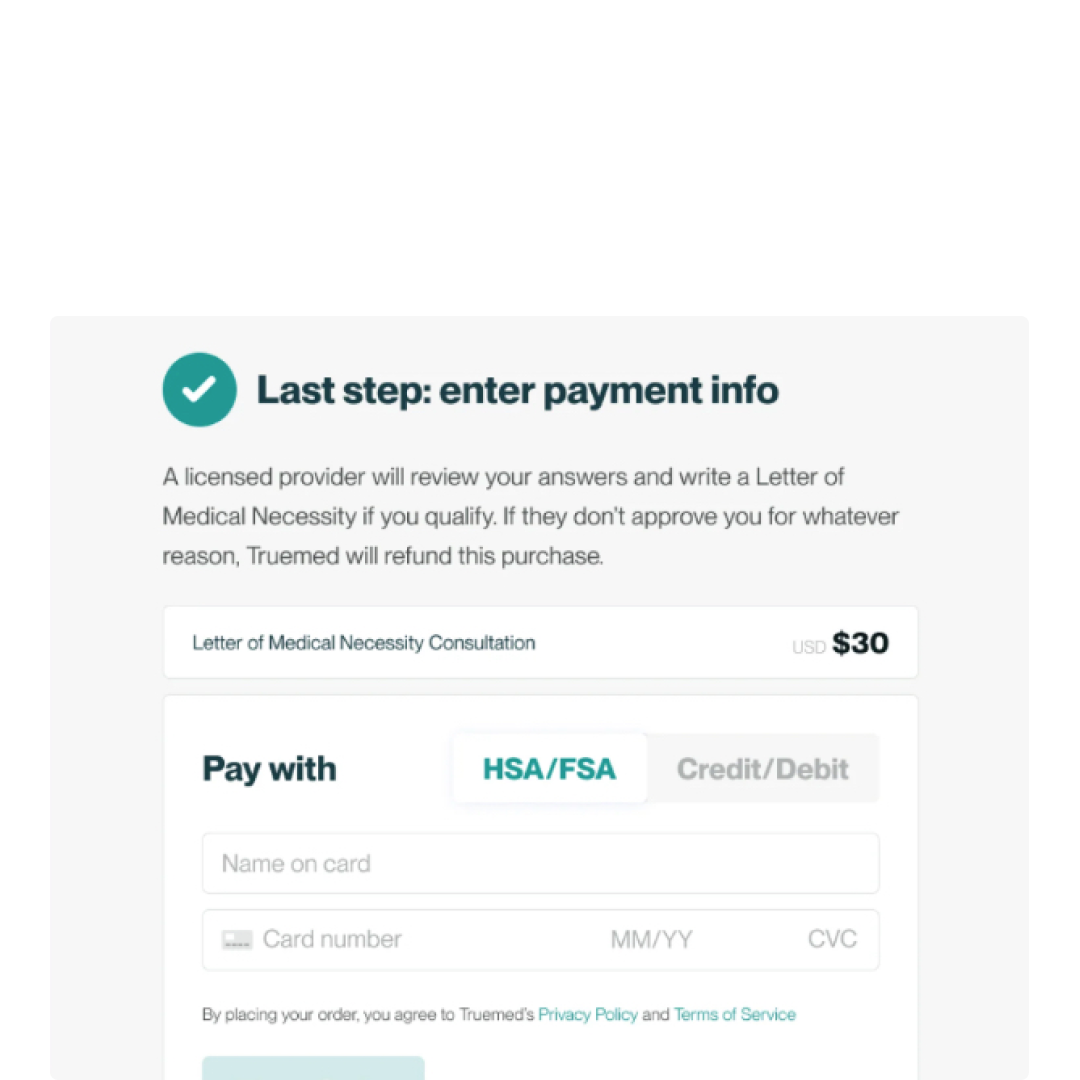

If you pay with your HSA/FSA card, there’s no other work you need to do. Truemed will send paperwork to ensure compliance. If you pay with your personal card, Truemed will send you reimbursement instructions.

Browse through our catalogue and add your chosen products to cart. Once you're done, proceed to checkout.

Ensure you are not signed into “Shop Pay” or any express checkout methods. If you're prompted for an OTP, close the pop-up. If you're already signed into "Shop Pay", checkout as guest at the bottom of the page.

Finish filling up the rest of the fields and proceed to payment methods. Once there, select Truemed. Upon clicking "Complete Order", you will be redirected to the Truemed page.

Answer a brief, guided health survey to confirm eligibility for HSA/FSA spending. A licensed professional will evaluate you based on your responses.

If you pay with your HSA/FSA card, there’s no other work you need to do. Truemed will send paperwork to ensure compliance. If you pay with your personal card, Truemed will send you reimbursement instructions.

How do HSA/FSAs help me save money?

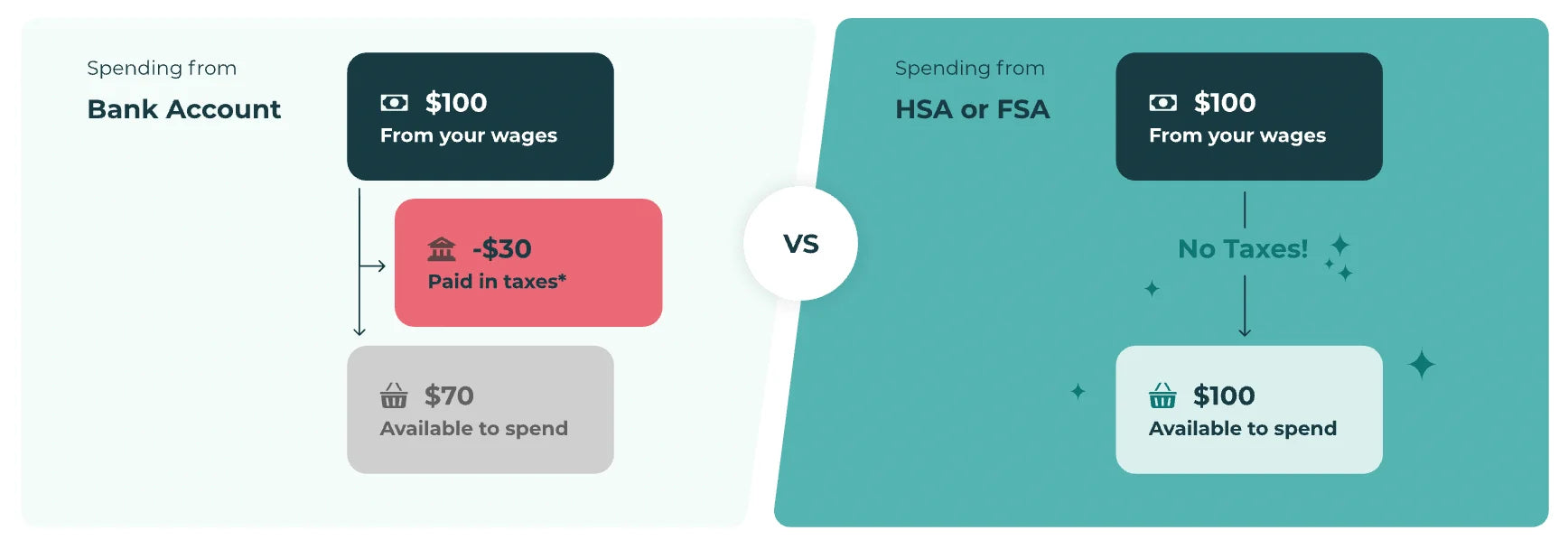

HSAs and FSAs were created for you to spend tax-advantaged dollars on products and services that can treat or prevent medical conditions and Truemed is making it easy to do just that.

Because HSA and FSAs use pre-tax money, you essentially have more purchasing power with your dollars. Instead of paying post-tax income on health items, qualified customers can use pre-tax funds to invest.

Shopping with your HSA/FSA

At Nordstick, we believe our products can be the right solution, and our new partners at Truemed agree. Through our collaboration with Truemed, eligible customers can now use Health Savings Account (HSA) or Flexible Spending Account (FSA) funds on our products! This means you may be eligible to buy your favorite fitness equipment with pre-tax dollars, resulting in net savings of 30% on average.

Visit Truemed to discover even more ways to spend your tax-free HSA/FSA funds.